Accounting Services and Professional Bookkeeping Services

Starting From INR 2499/-

We have a separate set of experts for each different domain to make sure excellence and prime quality altogether our services.

- Trusted

- Experienced

- Professional

Let’s Talk With Our Team

Accounting Services and Professional Bookkeeping Services

The purpose of bookkeeping and accounting services is cost reduction and cost management. Our specialized team of accounting professionals is equipped with to meet the needs and procedures of the business working. Our professional bookkeeping services of bookkeeping accounting are very beneficial for all types of businesses.

List of Services under Accounting?

- Payroll services

- E-Accounting services

- Preparation of financial statements

- Accounts payable/receivable

- GST Return filing

- TDS Return Filing

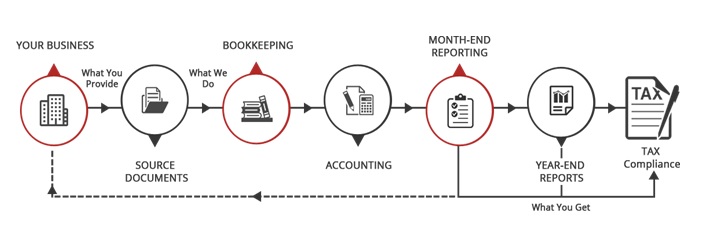

Taxujala Accounting Process

Get Best Service

Packages

- Charges for basic accounting services is Rs. 2,499/- per month.

Request a Call Back

GST Registration FAQs

Yes, you are required to obtain GST registration once your turnover exceeds the specified threshold limits.

If a business operates from more than one state, the taxpayer should obtain a separate GST registration for each state. For instance, If an automobile company sells in Karnataka and Tamil Nadu, he has to apply for separate GST registration in Karnataka and Tamilnadu respectively.

Small taxpayers who wish to have lesser compliances to deal with and lower rates of taxes under GST, can opt for the Composition scheme,

A trader whose aggregate turnover is below Rs 1.5 crore can opt for the Composition scheme. In the case of North-Eastern states and Himachal Pradesh, the present limit is Rs.75 lakh. Click here to know all about the Composition scheme.

Also, the government extended the Composition scheme to service providers having an aggregate turnover of up to Rs.50 lakhs. Click here to go through the Composition scheme for service providers.